Several years ago, I stumbled across an Instagram account of a young woman with several small children who had suddenly and inexplicably lost her husband. For whatever reason, her story captivated me. I spent at least an hour reading each and every detailed post about what had happened and how she had started to move forward with her life despite her loss. I distinctly remember lying in bed beside my sleeping husband, crying for this woman I had never met, and whispering prayers of gratitude that her life was not my life. That I had my husband with me. That a 30-something woman suddenly losing a healthy, strapping, 30-something husband was a rare occurrence. And that I didn’t have to worry about. I also distinctly remember saying to myself, “I couldn’t survive that.”

Little did I know that only a few short years later I would have to find a way to survive exactly that. One evening in late October of 2017, I was once again lying beside my sleeping husband in bed. Around 11:00 p.m., I was awoken by strange sounds coming from my husband. In my sleepy fog, I thought perhaps he was having a particularly vivid nightmare. I tried to shake him awake. But he wouldn’t wake up. As I became more aware, it dawned on me that he wasn’t dreaming at all. It seemed like he was having a seizure of some kind. And that’s when I became terrified.

When the Unthinkable Happens

I went into panic mode and grabbed my cell phone to call 9-1-1. Before I had completed dialing, my husband became unresponsive. I ran out of the house and across the yard to my neighbors home. Despite my confusion, I knew that it was likely I would be accompanying my husband to the hospital and I still had two sleeping babies upstairs. I needed someone to help me, and my neighbor was the closest person I knew to ask. Luckily, they were home and they came running to my aid.

My neighbor, Tom, helped me get my husband off the bed and onto the floor while the 9-1-1 operator told me how to perform CPR. Despite my efforts, my husband remained unresponsive and was quickly turning blue. Within minutes, EMTs arrived and took over trying to revive my husband. I went to my closet and put on shoes and grabbed a sweater. Praying desperately for God to breathe life back into my husband, I remember telling God that I couldn’t lose him.

Tom drove me to the hospital while his wife, Tricia, stayed at my home to watch over our sleeping babies. I cried and prayed all the way to the ER. When we arrived, the nurses led me to a small, quiet room where I continued to beg God for a miracle. A few minutes later, a nurse came to get me. She lead me into the ER room where my husband was being worked on. She told me it didn’t look good. They were doing everything they could, she said. Ultimately, though, none of it was enough. That night I watched my husband die. That night my life changed in ways I could never imagine.

The End of Life as I Knew It

It turns out, that night was only the beginning of the nightmare that I would have to survive. It took several days to get answers about what had happened to my husband. Evidently, he had a genetic heart defect that no one knew about. His heart was a ticking time bomb and it was only a matter of time before it gave out. There was nothing anyone could have done to save him. But, as I would come to find out, there were a lot of things he and I could have done to prepare better for what was to come.

Hindsight is 20/20

As an attorney, you would think that I would have made getting our wills done and securing life insurance for each of us a priority. And it’s not that getting our ducks in a row wasn’t a priority. It’s just that we were young and fit and healthy. Why do today what you can put off until tomorrow, right?

In fact, I had actually drawn up our wills a few years prior, but we never signed them because we had a new baby on the way. And then we moved. And then we simply forgot. We also never purchased any significant life insurance policies because we thought they were expensive and we were living paycheck to paycheck. We’ll get around to it soon, we said. We have time, we thought.

But we were wrong. What we didn’t consider is that if he died, our entire family would be left without income. I had been a stay-at-home mom since our first baby was born. I gave up my career in law to take care of our family. My husband was our sole provider and the source of all of our health insurance. Everything we had, all the benefits, all the income, all the retirement, everything existed because of my husband. And when he was gone, so was the rest of it.

About a week after he died, I learned from his employer that we didn’t have any life insurance policies. Also, if I wanted to continue our healthcare coverage, it would cost me $800 a month. The devastation that I was experiencing from the loss of the love of my life was now compounded with the realization that I was also about to lose everything else we had built together. My home, our vehicles, our insurance, our way of life. All because we didn’t prepare for the worst when we had the chance.

What Can You Do to Prepare?

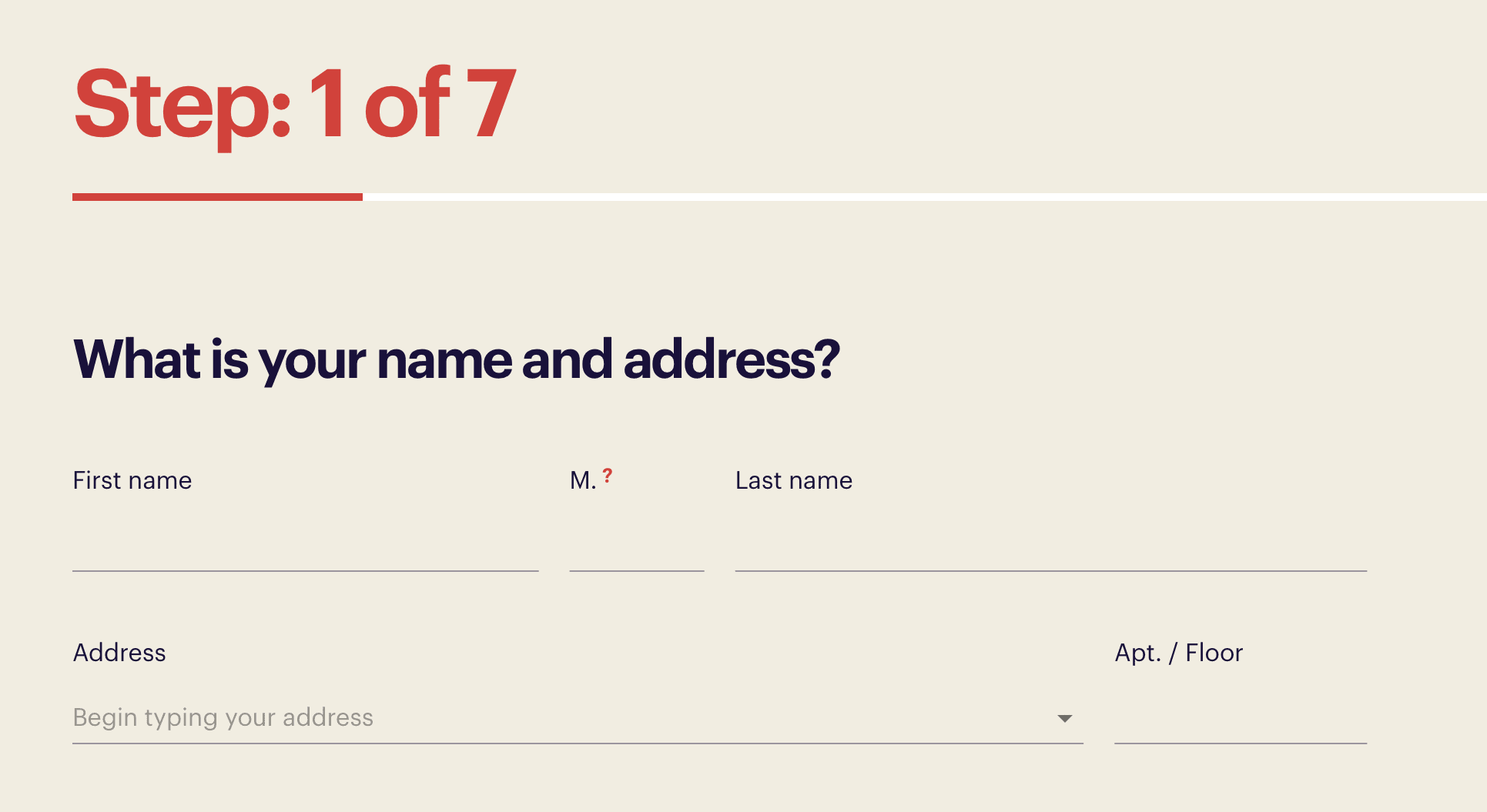

Since my husband died, I have become a passionate advocate for preparing responsibly. I want people to learn from our mistakes. Besides having your wills written immediately, I always advise people to purchase some sort of life insurance that would help them financially if the worst were to happen. One insurance product that I have discovered recently, and that I wish we had had the opportunity to purchase, is by a company called Dayforward.

Why Consider Dayforward?

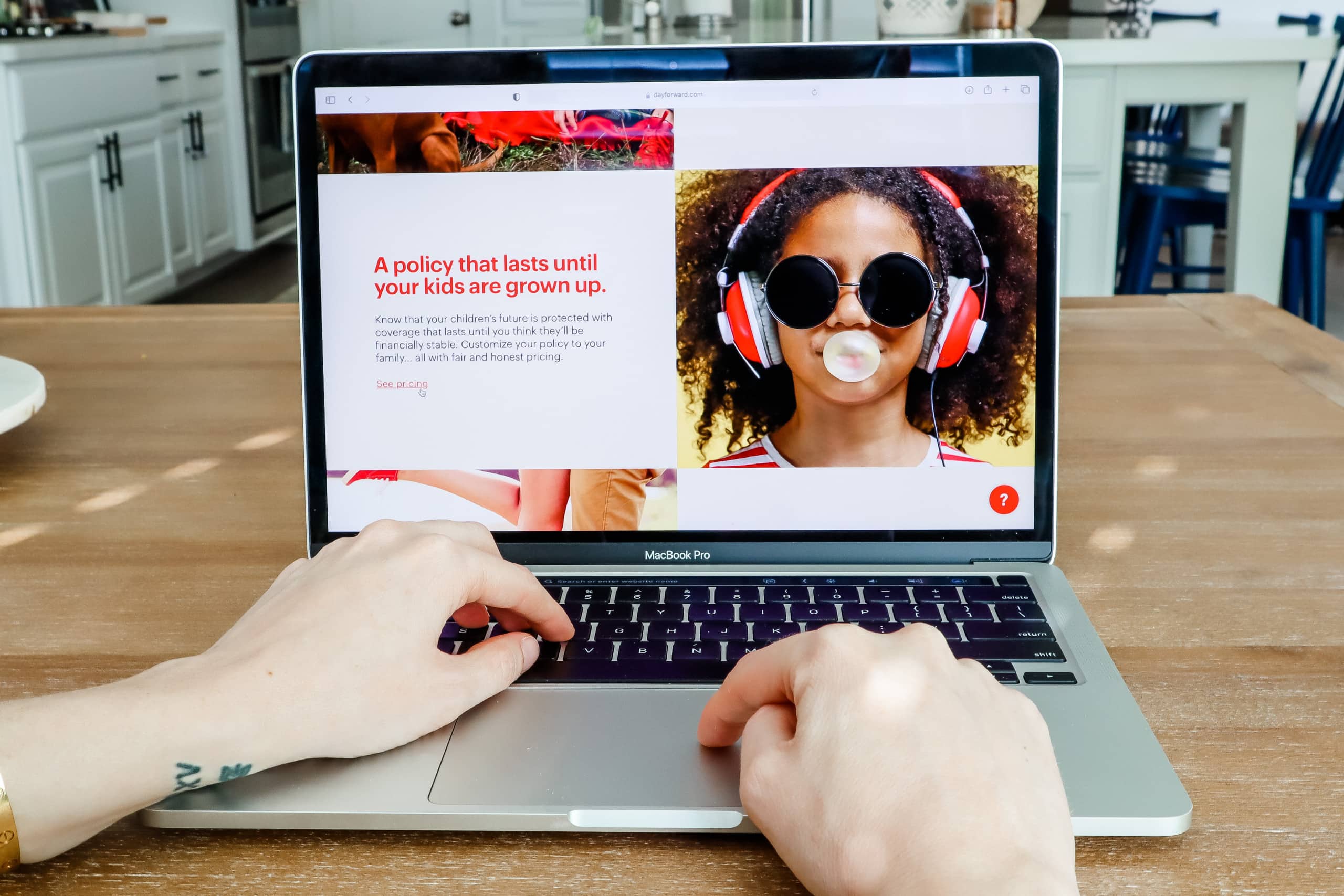

Dayforward offers a new type of life insurance that protects your family by protecting your income until your children are grown up. Traditional life insurance is a one-time, lump-sum payment that may or may not be enough to cover your living expenses for a short number of years.

For example, let’s say you buy a $350,000 life insurance policy and your husband brings in $100,000 a year after taxes. Let’s assume your husband dies and your children are 10 and 12 years old. You have to find a way to financially survive for at least 6-8 more years, but that $350,000 policy will likely cover approximately 3.5 years. If you’re lucky. And if it’s not misspent or mishandled, which tends to happen when people come into a large sum of money. It may seem like a lot of money at the time you purchase the policy, but the truth is that it is simply not enough to cover your expenses for a long time.

How is Dayforward Different?

Dayforward solves this dilemma by providing your family with a steady stream of income until your children are grown. You can even customize your policy to last until you believe your youngest child will be financially independent, whether it’s at 18, 21, or 26 years old. Dayforward will continue to send your family twice a month paychecks, similar to what you depend on today until your babies are adults. In a time when your world has turned completely upside down, having that regular paycheck despite having just lost your family’s provider offers great comfort and security.

Learn From My Mistakes

I wish Dayforward had been an option for me before I started this journey. I wish my husband and I had been more responsible and prepared for the unthinkable. There are so many things I wish could be different. At this point, though, what I hope is that my story can be used to inspire others to do what we didn’t.

If you stumble across this story, I urge you to do more than just think, “I’m so glad that’s not me. I don’t know if I could survive that.” Instead, sit down with your husband and have the hard talk. Set aside time and money to get your wills done and purchase life insurance. Open a bottle of wine and sit together and research Dayforward. Then figure out a way to start investing in your family’s future. It may be the most important discussion you have as a couple. Don’t let it pass you by.

This story and all opinions expressed in this paid testimonial are my own.